Success Story: How MuckerLab Cut Investor Management Time by 50% with a Custom Web App in 3 Months

Case Study Overview:

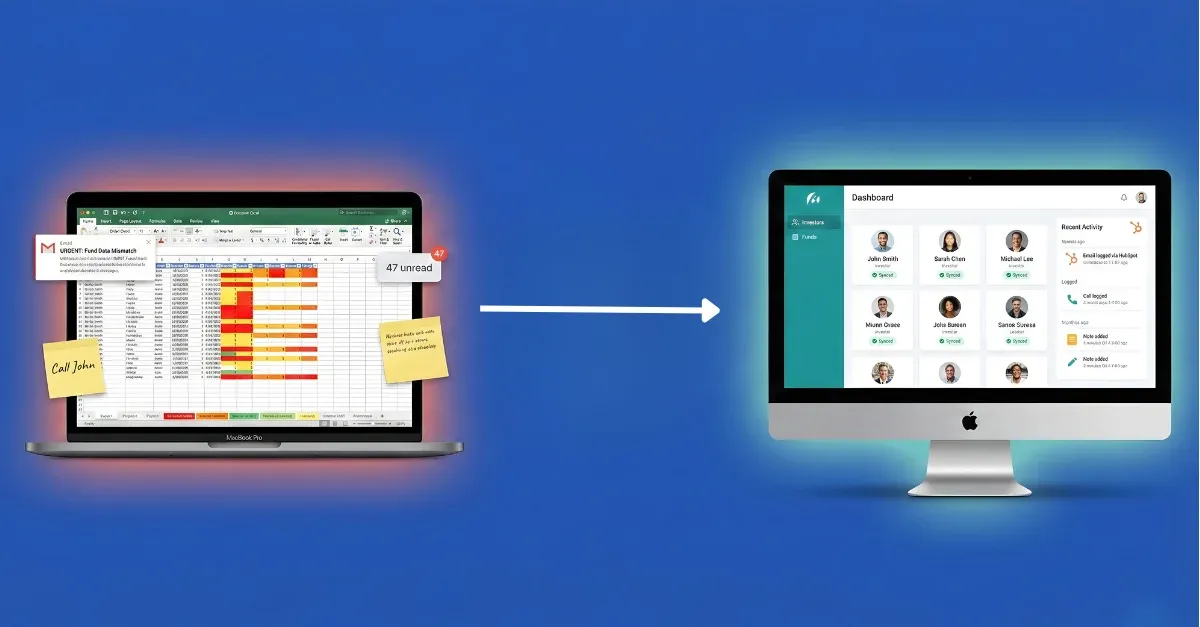

MuckerLab, a leading startup accelerator, was struggling with fragmented investor data, manual workflows, and disconnected email communication. As their investor base grew, operational inefficiencies started consuming valuable time and limiting scalability.

MuckerLab partnered with ThinkSys to build a custom investor management platform that centralized investor data, automated email tracking through HubSpot, and reduced operational effort by 40–50% in just 3 months. The solution replaced manual spreadsheets with a scalable, secure system designed for growing startup accelerators.

About the Client: MuckerLab

MuckerLab is a mentorship-driven accelerator based in Southern California. They work hands-on with internet and media entrepreneurs to help them launch, fund, and grow high-potential startups.

With deep involvement from partners and mentors, MuckerLab takes a high-touch approach, operating almost like an extension of the founding team.

But as their investor base expanded, managing investor relationships and fund data started pulling attention away from what mattered most: building companies.

The Challenge: Scattered Spreadsheets & Fragmented Emails

Before working with ThinkSys, MuckerLab faced several operational challenges:

- Scattered Data Across Spreadsheets: All investor and fund details were stored in multiple Excel files. It was inconvenient and risky. Updates often conflicted or went missing, leading to confusion and wasted time.

- Email Communication Was Fragmented: Investor conversations were happening through a basic email tool with no history tracking or structure. It was a bit hard to look back at a thread and know which fund or investor it belonged to.

- No Link Between Conversations and Fund Data: If an investor asked about a specific fund, the team had to dig manually through emails and files to connect the dots. There was no system to log or track which conversation went with which investment opportunity.

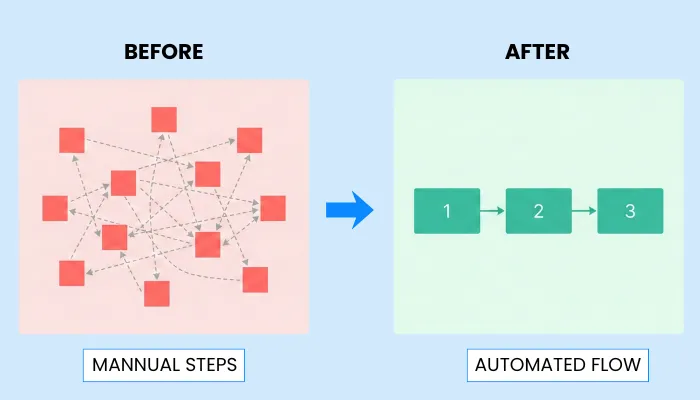

- Manual Work Slowed Down Growth: Every task, like tracking responses, updating fund details, and replying to investors, was manual. The more investors they onboarded, the more time they lost trying to keep everything in sync. It simply didn’t scale.

The Solution: Custom Investor Management Platform

ThinkSys designed and developed a custom investor management platform tailored specifically to MuckerLab’s workflows.

Core Capabilities Delivered

- Replace Spreadsheets with a Centralized Web App: We recommended a custom web application where all investor and fund data would live in one secure place, easy to search, update, and scale as the business grows.

- Track Every Email with HubSpot Integration: To bring structure to communication, we proposed using HubSpot’s email logging. This would automatically track conversations, eliminating the need to dig through inboxes.

- Map Conversations to the Right Funds: We explained how each email could be linked to a specific investor or fund using logic built into the app, making it easy to find full context instantly.

- Cut Manual Work with Seamless Workflow Design: We planned to eliminate tool-switching by designing a system that lets the team view, update, and act on data from one place.

- Build a Scalable Foundation for Growth: Instead of patching the old system, we aimed to build something they could grow with. Every feature was planned with future expansion and flexibility in mind.

Our Implementation Approach

Here’s how we tackled MuckerLab’s challenges with clear decisions and safeguards at each stage.

- Step 1: Auditing Existing Workflow and Mapping Data Relationships

We started by understanding how MuckerLab currently stores and manages its investor and fund data.

This meant reviewing all their Excel sheets, manual email threads, and the way they matched conversations to funding activity.

Our goal wasn’t just to replicate what existed, but to map relationships between data points: who invested in what, and when.

We also identified inconsistencies in naming and formatting that could cause future data mismatches if not resolved up front. - Step 2: Designing a Centralized Web Application for Fund & Investor Records

Based on the audit, we designed a web application tailored for their specific use case. Every investor and fund has its own profile page with linked records, updates, and histories.

We chose PostgreSQL for its relational strengths, ensuring one-to-many relationships (e.g., one fund to many investors) worked smoothly.

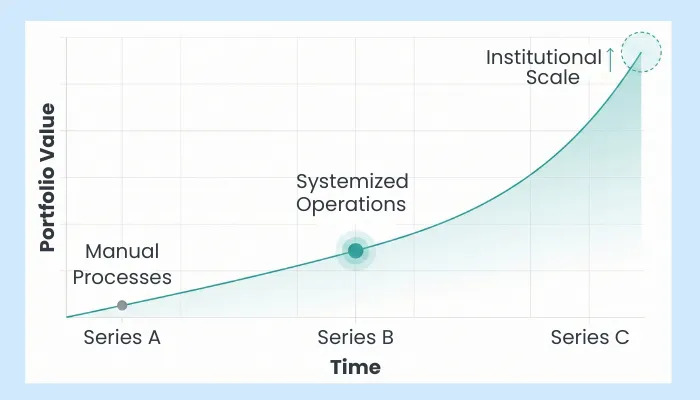

We also built with scalability in mind, anticipating that they might onboard institutional investors later.

Special care was taken to design a clean, fast search so they could find what they needed instantly. - Step 3: Integrating HubSpot for Seamless Communication Logging

One of MuckerLab’s biggest pain points was scattered investor conversations. To fix this, we integrated HubSpot’s email logging system.

Whenever someone emailed an investor, they simply copied a unique address, and HubSpot auto-logged the thread. We made sure this was embedded into the app UI itself to prevent user error.

We also tested multiple scenarios, forwarding, replies, and mass messages, to make sure nothing slipped through the cracks or got misattributed. - Step 4: Implementing Logic to Link Emails to the Right Fund or Investor

Just capturing emails wasn’t enough. They had to be contextually relevant. We built logic that auto-associated emails with the right investor or fund, based on sender/recipient metadata and timestamps.

We also allowed manual overrides to cover edge cases. This step required extensive testing to avoid false matches or missing links.

Our goal was to make the experience effortless so a team member could glance at any fund or investor and see the full communication trail immediately. - Step 5: Launching with Training and Feedback Loops

Once the system was built, we rolled it out with live onboarding and documentation. We walked the team through core workflows and gave real-time support during their first few weeks of use.

We also collected feedback and iterated on small UI improvements, such as filter labels, email preview formats, and field naming. This ensured the system was functional and intuitive for day-to-day use.

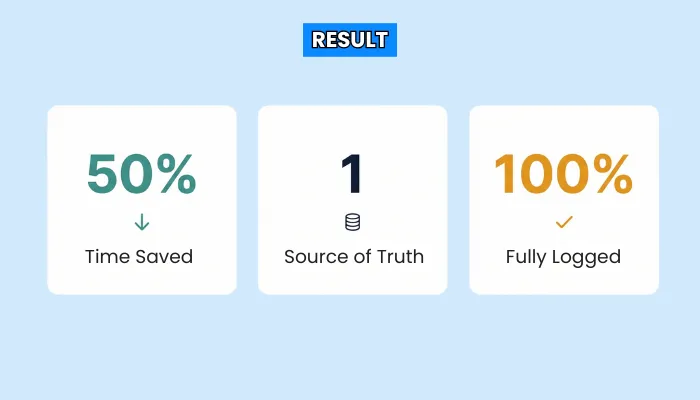

Key Results & Business Impact

Once the new system was in place, MuckerLab saw measurable improvements across the board. Here’s what changed:

- Investor Management Time Dropped by 40–50%: With everything in one place and no more manual cross-checking, the team could handle investor tasks in nearly half the time, freeing them to focus on higher-value work.

- All Data Centralized and instantly searchable: No more Excel files or duplicate records. The new web app gave the team a single, reliable source of truth for every investor and fund relationship.

- Full Communication History, Right Where They Needed It: Every email was automatically logged via HubSpot integration. The team could now pull up any conversation instantly, with full context, without switching tools.

- Workflow Became Smoother and More Scalable: Manual tasks were replaced with systemized flows. That made onboarding new investors faster and gave the team confidence that their tools wouldn’t break as they grew.

- Stronger Foundation for Growth: With the problems gone, MuckerLab started planning to bring in company-level investors. The system gave them the structure to scale relationships without sacrificing control or visibility.

Client Testimonial

ThinkSys helped us eliminate manual investor tracking completely. The new platform gives us clarity, speed, and confidence as we scale -MuckerLab Team

Conclusion

You’ve just seen how ThinkSys helped MuckerLab solve a complex investor management workflow and turn it into a streamlined, scalable system. By replacing manual tools with purpose-built technology, we helped them reclaim 50% of their time and focus on growth.

Why ThinkSys

ThinkSys specializes in building custom software solutions that solve real operational problems. From workflow automation to complex integrations, our teams design systems that scale with your business.

Frequently Asked Questions

Share This Article: